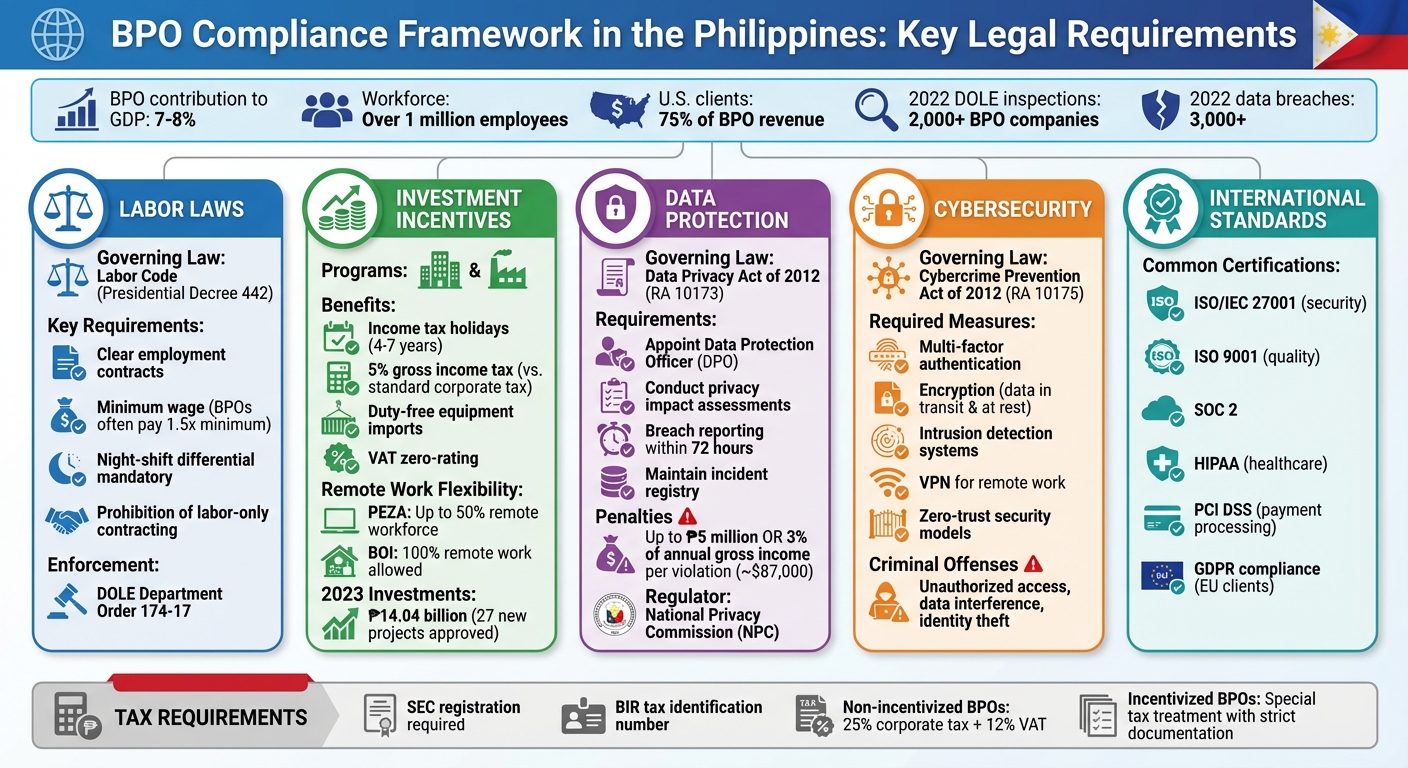

The Philippines is a global leader in business process outsourcing (BPO), contributing 7–8% of its GDP and employing over a million workers. However, U.S. companies outsourcing to the Philippines must navigate critical legal and compliance requirements. Here’s what you need to know:

- Labor Laws: The Labor Code mandates clear contracts, minimum wages (often exceeded in BPOs), night-shift pay, and prohibits labor-only contracting. Violations can result in penalties or reclassification of employers.

- Investment Incentives: PEZA and BOI offer tax breaks, VAT zero-rating, and flexibility for remote work. Companies must maintain compliance to retain these benefits.

- Data Protection: The Data Privacy Act requires robust safeguards, breach reporting within 72 hours, and adherence to NPC guidelines. Non-compliance can lead to fines up to ₱5 million or 3% of annual gross income.

- Cybersecurity: BPOs must implement IT security measures under the Cybercrime Prevention Act, including encryption, multi-factor authentication, and breach prevention protocols.

- International Standards: Many BPOs align with ISO, HIPAA, and PCI DSS to meet global client expectations, especially for U.S.-based businesses.

Compliance ensures operational stability, reduces risks, and builds trust with international clients. Choosing a compliant partner like 365Outsource.com can streamline these processes and help avoid legal and financial pitfalls.

Philippine BPO Compliance Framework: Key Requirements and Penalties

[WEBINAR] Business Regulatory Compliance Guide for the Philippines 2025

Legal and Regulatory Requirements for BPOs

Following the economic impact overview, this section looks at the key legal and regulatory frameworks that govern BPO operations.

Labor and Employment Laws

The Labor Code of the Philippines (Presidential Decree 442) serves as the primary guide for employment regulations in the BPO sector. It mandates that employment contracts clearly define job responsibilities, wages, benefits, and work schedules. While BPOs are required to meet the minimum wage, many exceed this by offering 1.5 times the minimum to attract and retain talent. For employees working night shifts in 24/7 operations, a night-shift differential is also mandatory.

DOLE Department Order 174-17 regulates the use of subcontractors, staffing agencies, or Employer of Record (EOR) arrangements. This order differentiates between legitimate contracting and labor-only contracting, which is prohibited. To be considered a legitimate contractor, a firm must be registered with DOLE, possess sufficient capital and equipment, and maintain control over its workforce. Failure to meet these criteria could result in the BPO client being classified as the direct employer, making them liable for labor obligations. In 2022, DOLE conducted over 2,000 inspections of BPO companies to ensure adherence to wage, overtime, and benefits regulations.

Investment Incentives and Economic Zone Regulations

Republic Act 7916, also known as the Special Economic Zone Act of 1995, led to the creation of PEZA, which offers a range of incentives to IT-BPO companies. These benefits include income tax holidays, a 5% gross income tax in place of standard corporate taxes, duty-free equipment imports, and VAT zero-rating on certain items. In 2023, PEZA approved new BPO investments, highlighting the ongoing attractiveness of these incentives.

The CREATE Law (RA 11534) and its update, CREATE MORE, revised the incentive framework for BPOs registered as Registered Business Enterprises. After an income tax holiday spanning 4 to 7 years (depending on location), companies can choose between a 5% Special Corporate Income Tax on gross income or enhanced deductions, which allow up to 200% deductions for expenses like training, research and development, and labor. Recent policy changes have added flexibility: PEZA-registered BPOs can retain incentives even with up to 50% of their workforce working remotely, while BOI-registered BPOs can implement 100% remote work and still qualify for benefits. This has led some firms to switch from PEZA to BOI registration to maintain their incentives amid return-to-office mandates.

Corporate Registration and Tax Requirements

BPOs operating in the Philippines must register with the Securities and Exchange Commission (SEC) to incorporate, obtain a tax identification number from the Bureau of Internal Revenue (BIR), and secure local government permits. Non-incentivized BPOs are subject to a 25% corporate income tax (reduced from 30% under CREATE), a 12% VAT on sales, and obligations to withhold taxes on employee compensation and supplier payments.

For incentivized BPOs under PEZA or BOI, maintaining clear accounting separation between registered and non-registered activities is critical. These companies must file specialized tax returns and document transactions eligible for VAT zero-rating or special tax treatments. Firms like 365Outsource.com already have the necessary SEC, BIR, and investment promotion agency registrations, enabling U.S. businesses to access compliant operations without setting up their own entity in the Philippines. Proper tax structuring and compliance are vital to avoid losing incentives, facing back taxes, or incurring penalties, all of which could affect pricing and operational stability.

With these legal and tax requirements addressed, BPOs must now turn their focus to meeting rigorous data protection and cybersecurity standards.

Data Protection and Cybersecurity Requirements

In addition to meeting regulatory demands for employment, investment, and taxation, BPOs must comply with strict data protection and cybersecurity standards to safeguard sensitive information.

The Data Privacy Act of 2012 (Republic Act No. 10173) lays out clear guidelines for handling personal data. BPOs, classified as personal information controllers or processors, are required to implement robust safeguards – organizational, physical, and technical – to protect personal information. These safeguards include limiting data collection to only what is necessary, maintaining clear privacy notices, enforcing role-based access controls, and documenting all data processing activities. To ensure compliance, BPOs must also train employees in proper data handling, restrict system access, and establish formal data retention schedules to manage information securely and responsibly.

Data Privacy Act of 2012 and NPC Requirements

With data breaches becoming more common, the National Privacy Commission (NPC) requires most BPOs to appoint a Data Protection Officer (DPO) to oversee compliance efforts and manage breach responses. Under NPC Circular No. 2023-06, organizations must conduct privacy impact assessments for each processing system and implement documented security measures, such as encryption, depersonalization techniques, and privacy-by-design frameworks. Additionally, BPOs must adhere to strict breach notification rules, reporting qualifying incidents to the NPC and affected individuals within 72 hours. They are also required to maintain an incident registry and implement remediation plans following any breach. Non-compliance can result in hefty fines; for instance, NPC Circular No. 2022-01 imposes penalties of up to 3% of annual gross income, capped at PHP 5 million (approximately $87,000) per incident. These measures are critical for ensuring secure international data transfers.

International Data Transfers and Security Standards

When U.S. companies transfer data to Philippine BPOs, the Data Privacy Act mandates adequate safeguards, even though the Philippines does not enforce EU-style adequacy requirements. U.S. companies must establish data processing agreements with clauses covering security, confidentiality, cross-border transfer protocols, and incident management procedures. Since U.S. clients account for about 75% of BPO revenue, many Philippine providers adopt internationally recognized standards – such as ISO/IEC 27001, SOC 2, HIPAA for healthcare, or PCI DSS for payment processing – on top of local compliance efforts. Companies like 365Outsource.com showcase their compliance through measures like network segmentation, endpoint protection, and encryption for data both in transit and at rest. These internationally recognized standards complement the local regulatory framework, ensuring compliance for both domestic and U.S.-based operations.

Cybercrime Prevention and IT Security Requirements

Beyond data protection, BPOs must also address cybersecurity risks under the Cybercrime Prevention Act of 2012 (Republic Act No. 10175). This law criminalizes offenses such as unauthorized access, data interference, system interference, and identity theft. To mitigate these risks, organizations are required to implement strong IT security measures, including robust authentication, logging, intrusion detection systems, and endpoint security. For remote and hybrid work setups, securing connections with encrypted VPNs, hardening devices, enforcing multi-factor authentication, and restricting local storage are essential practices.

Comprehensive policies covering acceptable use, remote work, access control, password management, backups, recovery, and vendor security further strengthen defenses. Regular employee training on cyber threats like phishing and social engineering – paired with simulated phishing exercises – helps to build awareness and resilience. Increasingly, BPOs serving U.S. clients are adopting zero-trust security models, which rely on conditional access and least-privilege principles to meet both NPC and international security expectations.

sbb-itb-5665bbf

Current Trends and Compliance Challenges

As the Philippine BPO sector continues to grow, it faces a mix of evolving trends and regulatory hurdles that demand careful attention. With changes in labor laws, tax policies, and cybersecurity measures, the industry must adapt to new rules while managing the risks tied to compliance. The rise of remote work, stricter enforcement of regulations, and the push for adherence to international standards are reshaping how BPOs operate and address compliance issues.

Remote Work and Hybrid Work Regulations

Remote and hybrid work setups have shifted from being temporary solutions to becoming standard practice in the BPO industry. However, these arrangements come with specific compliance requirements, especially when tied to tax incentives. For example, under the CREATE reforms, PEZA-registered firms can allow up to 50% of their workforce to operate remotely while maintaining a minimum number of on-site employees. In contrast, BOI-registered firms can fully adopt remote work while still enjoying their tax incentives.

In 2022, the Fiscal Incentives Review Board (FIRB) denied ecozone BPOs the option for full work-from-home operations, requiring them to return to on-site work starting April 1, 2022, unless they shifted their registration to the BOI. Meanwhile, the Telecommuting Act (RA 11165) ensures that remote employees receive the same pay, benefits, training, and career opportunities as their on-site counterparts. This law also adds new responsibilities for employers, including managing timekeeping, approving overtime, and ensuring occupational safety for home offices. These complex requirements demand increased oversight and compliance efforts.

Regulatory Enforcement and Penalties

Regulatory agencies have ramped up their scrutiny of the BPO industry. The National Privacy Commission (NPC) has implemented capped fines for violations, focusing on data privacy compliance.

The Department of Labor and Employment (DOLE) conducted over 2,000 inspections of BPO firms in 2022, targeting issues such as unpaid overtime, worker misclassification, labor-only contracting, and non-compliance with mandatory benefits like night-shift premiums and holiday pay. Unsafe practices during night shifts have also come under the spotlight.

On the tax front, the Bureau of Internal Revenue (BIR) has stepped up audits, particularly around VAT zero-rating for export services, proper documentation for tax incentives, and transfer pricing in related-party transactions. Non-compliance can result in hefty tax assessments, surcharges, and penalties, which could erode the cost advantages that make the Philippines an attractive outsourcing destination.

Meeting International Client Standards

As Philippine BPOs expand into specialized services such as finance, healthcare, legal operations, and cybersecurity, meeting international standards has become a top priority. U.S. clients often require certifications like ISO/IEC 27001, ISO 9001, PCI DSS, and HIPAA compliance, while EU clients expect adherence to GDPR through standard clauses in Data Processing Agreements (DPAs).

For example, BPOs handling payments must implement PCI DSS controls, while those in healthcare must align with HIPAA and HITECH standards – even though these U.S. laws aren’t directly enforceable in the Philippines. Providers achieve compliance by securing certifications and integrating GDPR-compliant practices into their operations. This involves detailed processing records, encryption, access controls, logging, and incident response measures, which must satisfy both local NPC requirements and international client expectations.

Companies such as 365Outsource.com illustrate this dual compliance strategy by implementing measures that meet both Philippine regulations and global standards.

The combination of stricter local enforcement, changing remote work policies, and rising international expectations highlights the importance of strong governance, risk management, and compliance systems to keep BPOs competitive and efficient in a demanding global market.

Conclusion

Overview of Compliance Requirements

The Philippine BPO industry operates under a structured compliance framework. The Labor Code of the Philippines (Presidential Decree No. 442) sets employment standards, while incentive programs like the Special Economic Zone Act (Republic Act No. 7916) and the CREATE Law (Republic Act No. 11534) offer tax holidays, duty-free imports, and flexibility for remote work – provided companies meet registration requirements.

Data protection is another critical area. The Data Privacy Act of 2012 (Republic Act No. 10173) requires companies to assign Data Protection Officers, conduct privacy impact assessments, and report breaches to the National Privacy Commission (NPC). Meanwhile, the Cybercrime Prevention Act of 2012 (Republic Act No. 10175) mandates strong IT security systems. Non-compliance can lead to fines of up to ₱5 million (around $87,000) or 3% of annual gross income per violation. In 2022 alone, the BPO sector reported over 3,000 data breaches. These regulations form a foundation that businesses must adhere to for sustainable operations.

Why Compliance Matters for BPO Operations

Compliance is more than a legal requirement – it’s a driver of growth and trust. In 2023, PEZA approved 27 new IT-BPO projects, bringing in ₱14.04 billion in investments. This highlights how compliant businesses attract capital and fuel expansion. For BPOs catering to international clients – who generate about 75% of the Philippines’ BPO revenue, predominantly from the U.S. – meeting both local and global standards fosters trust and opens the door to high-value contracts. Adhering to frameworks like ISO/IEC 27001 and GDPR ensures security and reliability in sectors such as finance, healthcare, and cybersecurity.

The Information Technology and Business Process Association of the Philippines (IBPAP) recently reported that the industry exceeded its revenue targets for fiscal year 2024, with further growth expected in 2025. For U.S.-based businesses, partnering with compliant BPOs reduces risks while maintaining operational excellence.

Choosing Compliant BPO Partners

Amid these stringent standards, selecting a compliant outsourcing partner is crucial. Ensure your BPO partner is registered with PEZA or BOI to confirm eligibility for tax incentives and compliance with hybrid work regulations. Verify adherence to the Data Privacy Act, including the appointment of a Data Protection Officer and implementation of NPC-recommended security protocols. Additionally, confirm compliance with the Labor Code and alignment with international privacy and security standards through established frameworks, encryption methods, and incident response systems.

For example, companies like 365Outsource.com showcase how compliance can be seamlessly integrated into operations. They provide staffing solutions in areas like digital marketing, web development, data processing, and virtual assistance – all while adhering to Philippine regulations and global standards. Choosing partners with a strong compliance record minimizes legal, operational, and reputational risks, allowing businesses to benefit from the cost savings and skilled workforce that make the Philippines a top outsourcing destination.

FAQs

What compliance requirements should U.S. companies be aware of when outsourcing to the Philippines?

U.S. companies outsourcing to the Philippines need to adhere to Philippine labor laws, which include providing proper employee benefits and safeguards. Additionally, they must comply with the Data Privacy Act of 2012, which outlines strict rules for managing personal data securely. Contracts should not only meet local legal requirements but also clearly define the responsibilities of all parties to minimize the risk of legal complications.

Equally important is following international standards for data security and confidentiality to protect sensitive information. By establishing well-defined service level agreements (SLAs), companies can align with both Philippine and U.S. legal requirements while promoting transparency and accountability in their outsourcing relationships.

What is the impact of the Data Privacy Act on BPO operations in the Philippines?

The Data Privacy Act of the Philippines mandates that BPO companies adopt stringent measures to safeguard personal data. This involves maintaining the confidentiality, integrity, and security of all processed information. To comply, companies are required to implement specific data handling protocols, designate a Data Protection Officer, and align their practices with global privacy standards.

By adhering to these regulations, BPOs not only meet compliance requirements but also strengthen trust with their international clients through responsible data management.

What benefits do PEZA and BOI provide to BPO companies in the Philippines?

The Philippine Economic Zone Authority (PEZA) and the Board of Investments (BOI) provide a range of perks for BPO companies operating in the Philippines. These include income tax holidays, exemptions from specific taxes and duties, and simplified registration procedures.

These incentives aim to attract more investment into the outsourcing sector, lower operational expenses, and help businesses expand within the country.